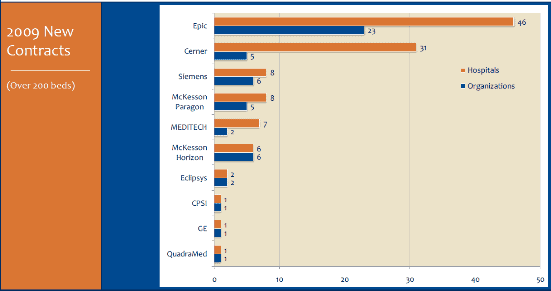

Nearly 70 percent of CIS purchases in 2009 by hospital over 200 beds were an Epic or Cerner integrated solution, according to a new KLAS report, “CIS Purchase Decisions: Riding the ARRA Wave.”

Click on the player below to hear a podcast with the report authors

In 2009, Eclipsys, GE, McKesson Horizon, and QuadraMed all lost more hospitals than they gained, according to the Orem, Utah-based company.

Although they did not realize the same increases as Epic and Cerner, Meditech and Siemens both saw limited growth of their currently marketed solutions, KLAS found.

Meditech users share concerns that MAGIC and early C/S platforms do not provide the features and functionality needed to meet Meaningful Use requirements, and that there may not be enough time available for them to implement C/S v.6 and meet the coming deadlines, the report indicated.

Siemens Soarian growth continues slowly, but Siemens overall footprint is shrinking as providers replace the legacy solution Invision with another system, KLAS stated.

Recent and pending changes in the market segment may shift the EMR purchase pendulum, according to the report. McKesson’s Paragon product was originally developed for a community hospital environment, but sold to more large hospitals in 2009 than its Horizon solution did.

Some providers are looking forward with cautious optimism to GE’s release of Quilibria, the result of collaboration with Intermountain Healthcare, even with GE’s customer satisfaction rating decreasing by five points in 2009, KLAS found.

Podcast: Play in new window | Download (32.1MB)

Subscribe: Apple Podcasts | Spotify | Android | Pandora | iHeartRadio | Podchaser | Podcast Index | Email | TuneIn | RSS

Share Your Thoughts

You must be logged in to post a comment.