Bill Russell, Founder & CEO, Health Lyrics (Former CIO, St. Joseph Health)

The CVS/Aetna deal represents a possible change in the way we think about healthcare companies. The combination of the local drug store and the data/analytics powerhouse of an insurance carrier presents some interesting possibilities. I thought we would look at another industry to consider what strategy health systems might consider in embracing this changing landscape.

These two sub-headlines from this year should give you some indication of JP Morgan Chase’s strategy for a digital economy:

- JP Morgan Marshals an Army of Developers to Automate High Finance

- JP Morgan Chase Earnings 75% of its Deposit Growth Comes From Bank Branches

The strategy is high-tech, being built by an army of developers, and high-touch, including retail locations in your neighborhood with personal bankers.

You would think that this represents cognitive dissonance for the leadership team. You could envision fiefdoms that are competing for mindshare and investments within the organization to grow their part of the business. One side arguing that brick-and-mortar and personal banking is what this company was founded upon; after all, our recent performance proves that this model still works. The other side, of course, cites the convenience being demanded by the consumer, which has driven the number of transactions being conducted digitally through the roof.

JP Morgan has correctly identified a tipping point in the age of the consumer, and they are taking action by investing heavily.

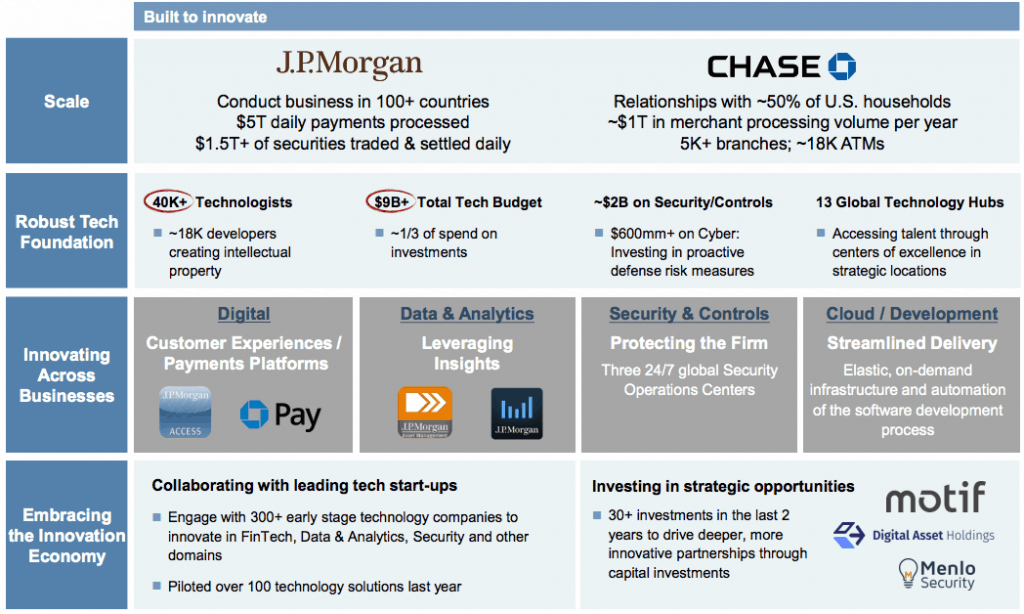

Check out this graphic from 2016. Think about these figures: a $9B total tech budget, $2B in security, and 18,000 developers.

JP Morgan: ‘We are a technology company’ – Business Insider February 23, 2016

In actuality, the strategy is in perfect harmony in the consumer’s mind. We want automation and convenience for the simple transactions in life. We use our phones to check our balances, pay our bills, order checks, trade stocks, and transfer money, among other things.

However, we also want the ability to speak to a personal banker when needed. If we are starting a new business, buying a home or car, or embarking on any number of big life decisions, we just want the option to talk it through with someone.

The healthcare consumer is asking for the same strategy and the leaders are starting to make their moves. There were five blockbuster healthcare mergers discussed in the media this past week. Disruption is well underway.

Are we investing our resources to get in front of the movement, or are we investing in simply preserving the status quo?

Where Healthcare Invest to Get in Front of Disruptions

Get Local

All healthcare is local, as I’ve been told many times. And if that’s really the case, the CVS/Aetna deal should scare the bejabbers out of health systems.

I hear the naysayers already: CVS minute clinics were supposed to change things and didn’t… why is this different? Well, for one reason, CVS has declared that they are a healthcare provider, not a pharmacy that also has a doctor onsite.

If I were a healthcare CEO, I would invest heavily in retail strategy. Convenience is winning in finance for JP Morgan, and it is going to win in healthcare, as well. You need to get into apartment complexes, business, prime retail spaces. Get smaller, get local, and get personal.

Get Personal

Know thy customer. This is the first commandment of a digital economy, and consumer insights should be the primary thing that determines your investments.

Healthcare is undergoing a shift in the consumer’s mindset thanks to high deductible health plans. When the health-spend is coming from the consumer, they will drive change. They will research the doctor and the health system, compare prices, scour reviews, and then report back to social media.

This is an obvious and impactful change in the consumer. Do your investments for next year reflect this change? How many of your patients want telehealth? How many want concierge medicine?

…Do you even know the answer?

If I were a healthcare CEO, I would invest heavily in analytics, starting with a comprehensive consumer analysis of the markets served. How do they consume the services we provide, both from us and others in the market?

Get Convenient

Here are the current healthcare buzzwords: Coordinated, Frictionless, Multi-Channel, Always On. Dismiss them because I called them “buzzwords” at your own peril. Health systems that can deliver on the promise of these buzzwords will remain relevant.

The challenge is that healthcare is a complex web of approvals, procedures, tests, and payments. The reality is that customer doesn’t really care about your challenges. This is the opportunity in market-driven healthcare and where you should invest.

If I were a healthcare CEO, I would start by putting measures in place to determine our baseline for coordinated, frictionless, multi-channel, always on and whatever other drivers my consumers tell me are important to them. I would then review our strategies and investments to ensure that they are aligned to deliver on the promises that our consumers are looking for.

Rethink Revenue

There are emerging, dying, and established revenue models. Know where your revenue falls on that curve. Then, invest accordingly.

You don’t want to run away from revenue models that are working today – they are a result of your investments all those years ago. Just don’t keep making investments in revenue models that are moving towards extinction.

Don’t become a slave to protecting current revenue streams. As George C. Scott says whilst playing General Patton, “Fixed fortifications are monuments to the stupidity of man.” In other words, your cash rich revenue streams today are visible targets for your competitors.

If I were a healthcare CEO, I would align my resources to identify new revenue models. Future revenue is a direct result of your investments today in R&D. No, we didn’t have to think this way in the past. We aren’t living in the past, though.

Master the Basics

A digital economy still runs on the basics: high-quality service or product, good value for the consumer, and great customer service. All of your work won’t mean a thing if you don’t have places to park, the doctors are rude, you have a bad reputation in the marketplace, or your pricing isn’t competitive.

If I were a healthcare CEO, I would cement my continuous process improvement initiatives to always be fine tuning our work. Iterate to perfection by making it better every day.

Investment Returns

JP Morgan’s technology investments have totaled between 8%-10% of revenue over the past eight years. There is a good chance that their performance is closely tied to these investments, and is matching their efforts to meet the needs of their changing consumers.

The challenges and messiness of healthcare represent a great market opportunity. It will take courage, boldness, and most of all leadership to make the most of that opportunity.

This piece was written by Bill Russell, a former CIO at St. Joseph Health who now serves as CEO of Health Lyrics, a management consulting firm. To view the original post, click here. To follow Russell on Twitter, click here.

Share Your Thoughts

You must be logged in to post a comment.